ATO严查度假屋税务申报:业主需高度关注

对于许多澳大利亚家庭而言,海边小屋或滑雪公寓通常兼具两种用途。一方面,它是家人度假休闲的私人空间;另一方面,在自用以外的时间,会通过 Airbnb 或

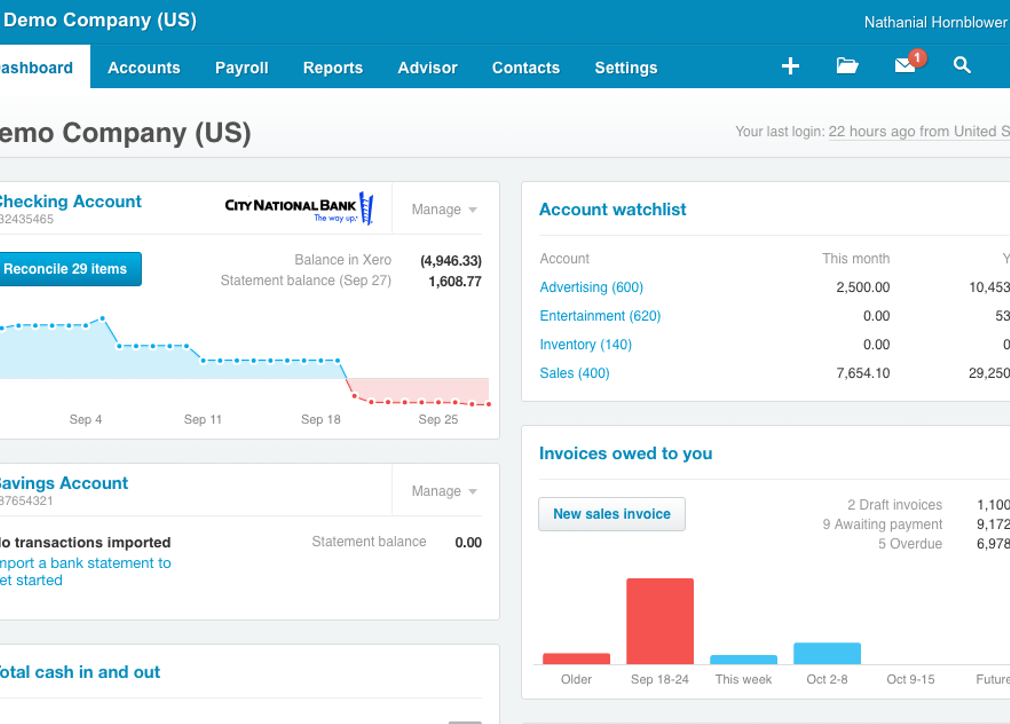

One of services that we pride ourselves on is the cloud accounting service. Pitt Martin is a certified advisor for the cloud accounting software Xero, Quickbooks, MYOB and Reckon One. We believe technology can change the world and if you don’t adapt to new technology you will be out of the game.

Traditionally, accounting software is installed in a particular device such as a computer, laptop, or tablet. Cloud accounting utilises cloud technology to host the accounting software in a remote cloud server. All devices can then access that accounting software through a login on a website, just like logging in to your online email.

Cloud accounting software enables clients, their staff and most importantly their accountant to access the same data and work on that data simultaneously. Clients can communicate with us and save all files on the cloud accounting platform. Therefore, they will not need to take, post or email documents to our office for bookkeeping. In addition, the cloud accounting software allows for auto bank feeds, semi-auto data entry and instant financial reports. All these features dramatically save time and improve the efficiency in communication.

Because the cloud accounting platform or software is accessed through a website, as long as there is an internet connection, clients can access and work on their files at any time and anywhere around the world. It also can be accessed through your work station, travel tablet or even your mobile phone.

Cloud accounting makes a client’s data more secure than ever. The reason for this is that the cloud accounting platform is stored on a provider’s server. Providers spend vast resources to protect the data parked on their server from being stolen, hacked, etc and all data is backed up at different places so clients need not worry that their data may be lost due to changing their devices, nature damage and so on.

Traditional desktop software requires updated software regularly in order to meet changes in the tax rate, withholding rate, superannuation percentage, etc. Most current market cloud accounting platforms will automatically upgrade everything on the server from the background. This makes compliance work much smoother for clients.

Our team can pick and choose the right cloud accounting provider for you. Then setup and configure the software ready to use including choosing the right accounting basis, BAS report period, Chart of Accounts, invoice branding, bank feeds and payroll features.

If you want to take part or arrange for full daily bookkeeping of your business, our team can offer both initial and ongoing training and support to you or your staff. It can be face to face, on the phone, or by video meeting.

If you want to focus your energy on your business, we have a qualified team to perform daily bookkeeping for you. Because of the cloud accounting platform, you can review the updated data and performance of your business instantly anytime and anywhere.

Business advisory is one of our team’s strengths and focusses currently and for the future. We utilise the instant updating feature of cloud accounting platforms to react quickly to our clients’ business performance. Hence we are able to provide advice to our clients in a timely manner to improve their cash flows, form strategies to increase sales and cut expenses, ratio analysis for compliance risk, and even lead to assistance in structuring your business for tax effectiveness and legal protection.

Michael V

Principal of Johnston Vaughan Solicitors & Attorneys

We are using Pitt Martin to look after our tax, accounting and trust account. Their down to earth work, prudent attitude and valuable advice have freed us a lot of time from the accounting and tax compliance burden, so we can focus our energy on the core legal practice business. We highly recommended Pitt Martin to be your professional accountants and business advisors.

Yu W

Director of Great Master Kitchen Pty Ltd

Pitt Martin helped us to setup the accounting software and trained our staff. During the years, they have provided many useful advices to us, applied government incentives for us, saved us heaps time and money in tax. I would say they are trust worth accountants not only in doing our tax but also giving business advice. Nevertheless, their friendly team is always there for you and being considerable. We are glad that we have worked with them for these years.

Victor C

Director of Wild Catch on Danks

Hi, we are in hospitality industry. I have been dealing with Pitt Martin since I opened my business. The service I receive from Robert and team is very professional. The advice I get is also very helpful in regard to making financial decisions. Robert is very approachable and has sound knowledge in relation to giving business advice and also any tax advice. I highly recommend Pitt Martin to anyone who wishes to take on their own business venture to seek advice from Robert and team. Their prices are quite competitive in the market, but the knowledge and service they provide goes beyond that.

Please let us to assist you. Submit your info via the form and one of our expert advisor will get in touch with you shortly.

对于许多澳大利亚家庭而言,海边小屋或滑雪公寓通常兼具两种用途。一方面,它是家人度假休闲的私人空间;另一方面,在自用以外的时间,会通过 Airbnb 或

For many Australians, a coastal cottage or ski apartment serves two purposes. It provides a personal retreat for family getaways and, when not in use, is listed on

管理自管退休金基金(SMSF)可以让受托人对退休储蓄的投资方式拥有更大的控制权。然而,这种控制权也伴随着重大的法律责任。许多受托人低估了相关规则的