Followed by the first Stimulus Package plan announced on 12th March 2020, the federal government has rolled out the second and third Stimulus Package plan with a total amount of up to 200 billion dollars in last two weeks aiming at helping small and medium business and keeping Australians in jobs. Let’s take a look at what are they for both business and individual and navigate one suits you.

For business

JobKeeper payment

The JobKeeper payment will assist employer to retain their employee and quickly re-start when the crisis is over. Affected employer will be able to claim the fortnightly payment of $1,500 per eligible employee from 30th March 2020. The first payment will be received on the first week of May, lasting for maximum of six months.

Eligibility for employer (including Not-For Profit):

- Business turnover less than $1 billion PLUS turnover has been reduced by more than 30% (of at least one month compared to the same period of last year)

- Business turnover more than $1 billion PLUS turnover has been reduced by more than 50% (of at least one month compared to the same period of last year)

- The business is not subject to the Major Bank Levy

Eligible employee can be full-time, part-time and casuals (a casual employed on a regular basis for more than 12 months as at 1st March 2020). They must be an Australian citizen, Permanent Visa Holder, or a Special Category (Subclass 444) Visa Holder who is a Australian tax resident on 1 March 2020.

Self-employed individuals (Sole Trader) who meet the above turnover test are also eligible for JobKeeper Payments.

Register you interest and keep update with ATO.

Cash flow paid to eligible employers

As we mentioned in our previous article “How small and medium business benefit from the Stimulus Package”, eligible employers have the entitlement to claim equal to 50% of the PAYG Withholding amount with a minimum of $2000 and maximum of $25,000 even the withholding amount is nil. At this second package plan, the figures are lifted up to 100% cashback on PAYG Withholding, with an increased minimum payment of $20,000 and maximum payment of $100,000.

The cash payment will be provided in two phases. The ATO will automatically credit the first phase amount (from $10,000 to $50,000) to the tax payer’s ATO account after the BAS or IAS lodgement from 28th April 2020. Different cycle tax payer will be paid upon the lodgement as below:

- Quarterly lodgers – March 2020 quarter (due on 28th April 2020), and June 2020 quarter (due on 28th July 2020)

- Monthly lodgers – March 2020 (due on 21st April 2020), April 2020 (due on 21st May 2020), May 2020 (due on 21st June 2020) and June 2020 (due on 21st July 2020)

The second phase amount will be equal to the first phase amount. Different cycle tax payer will be paid upon the lodgement as below:

- Quarterly lodgers (each credit will be equal to 50% of the phase one payment), one after each BAS or IAS lodgement for June 2020 quarter and September 2020 quarter

- Monthly lodgers (each credit equal to quarter of the phase one credit) one after each BAS or IAS lodgement for June, July, August and September 2020

Government Guaranteed Unsecured Loan

The $40 billion guarantee for small business loan under the Coronavirus SME Guarantee Scheme is in place to support small and medium business in obtaining the additional working capital. The government will grant a guarantee of 50% to eligible small and medium business lenders which will reinforce lenders’ willingness and ability to provide credit.

Meanwhile, a deferred repayment of up to 6 months has been announced by the Australian Banks aiming at supporting small and medium business who has existing loans. Reserve Bank of Australia (RBA) has also announced a $90 billion Term Funding Facility for the banking system to lower the funding costs for banks and subsequently to encourage lending to businesses.

Temporary relief for financially distressed businesses:

- The threshold at which creditors can issue a statutory demand on a company has been increased from $2,000 to $20,000

- The threshold at which creditors can initiate bankruptcy notice has been increased from $5,000 to $20,000

- The time companies have to respond to a statutory demand and bankruptcy notice they receive will be extended from 21 days to up to 6 months

Directors will also be temporarily exempted from any personal liability arising from the trading during insolvency. The Corporate Act 2001 will also be amended to provide companies with temporary and targeted relief against unforeseen events caused by COVID-19.

For individual

JobSeeker Payment

The government introduced a temporary income support payment for the next six months, offering a fortnightly payment of $550, which is the double of the current allowance, to eligible job seekers who lost their jobs during the pandemic. This supplement will be an additional payment paid on top of their existing allowance to both existing and new eligible recipients (including those currently receiving JobSeeker Payment, Youth Allowance, Parenting Payment, Farm Household Allowance and Special Benefit)

One-Off $750 Economic Support Payment

On top of the one-off $750 economic payment released by the government on 12th March 2020, the government will be providing second $750 income support payment to social security, veteran and other income support recipients and eligible concession card holders (except for those receiving the Coronavirus supplement).

The first $750 payment will be available from 31st March 2020 to individual who becomes eligible from 12 March 2020 to 13 April 2020.

The second $750 payment will be made automatically to eligible payment recipient and concession card holders from 13 July 2020

Early Access to Superannuation

Eligible individual affected by the COVID-19 have earlier access up to $10,000 of their superannuation in 2019-20 and a further $10,000 in 2020-21 to help them relieve the financial hardship. The first period for them to access their superannuation is between 20 April 2020 and 1 July 2020. The second period is between 1 July 2020 and 24 September 2020.

To apply for early released superannuation, you must satisfy any one or more of the following requirements:

- You are unemployed

- You have the entitlement to receive a JobSeeker payment, Youth Allowance for jobseekers, Parenting Payment, Farm Household Allowance and Special Benefit

- On or after 1 January 2020,

- You were made redundant

- Your working hours were reduced by 20% or more

- If you are a self-employed individual (Sole Trader), your business is forced to suspend or your turnover has fallen by 20% or more

Early released superannuation is not subject to income tax, and the money you are claiming will not affect Centrelink or Veteran’s Affairs payments.

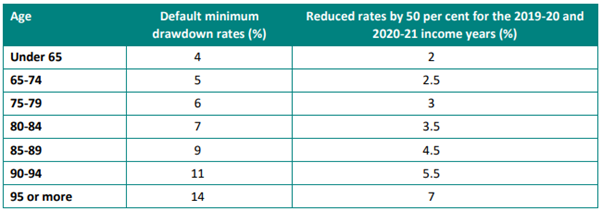

Reduce the minimum superannuation pension drawdown rates

The minimum superannuation drawdown rates for account-based pension and similar products will be reduced by 50% for 2019/20 and 2020/21. The pensioners who hold these products will be benefit from this measure because they do not have to sell their products to meet the minimum withdrawal requirement under the current financial market downturn.

Minimum pension drawdown rates halved for 2019/20 and 2020/21:

Given all the measures rolled out by the government in respondence to the outbreak of COVID-19 are temporary and applications are required with supporting fact and explanation, both business and individual should examine their own situation and check for the subsidies they are entitled in order to turn around their business and life during the outbreak. If you need any assistance for the consultation or application, please do not hesitate to reach us on 02 92213345 or connect@pittmartingroup.com.au.

Disclaimer: This article is not providing a formal advice and may not suit to all scenarios. Please make an appointment with us to discuss.

Experienced Tax Accountant and Business Advisor with a demonstrated history of working in the accounting and mortgage industry. Skilled in Tax, Accounting, Business Advisory, SMSF, Audit and Mortgage. Strong entrepreneurship professional with qualification Master of Professional Accounting, CA Public Practice, Registered Tax Agent, Registered ASIC Agent, NSW Law Society External Examiner, Trust Account Auditor and Diploma of Finanical Planning. Specialised in SME, tax planning and international tax, he helped client save ample money and create wealth.